Weekly Manhattan & Brooklyn Market: 10/30

Week of 10/30

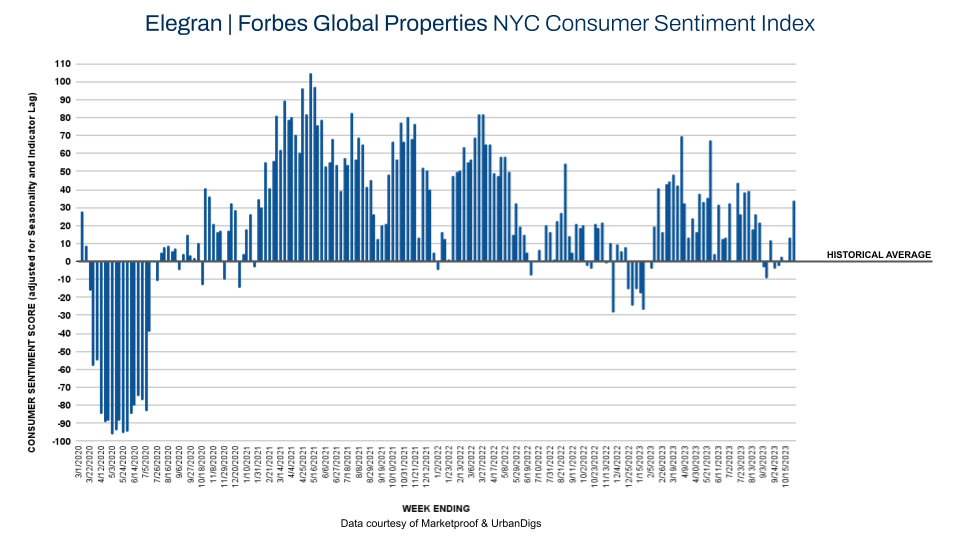

Consumer Confidence High Despite 7.5% Jumbo Rates

This week, even though mortgage rates are rising, they're not slowing down New York City's real estate market. In fact, this past week demand was higher than the seasonally adjusted pre-pandemic average. While higher rates usually make people less excited to buy, in NYC, demand fluctuates differently because many deals are made with cash, not mortgages. About 40% of NYC's real estate purchases don't depend on mortgage rates, so they're less affected when rates go up. Wealthy buyers and foreign investors see NYC properties as a safe, desirable and valuable investment.

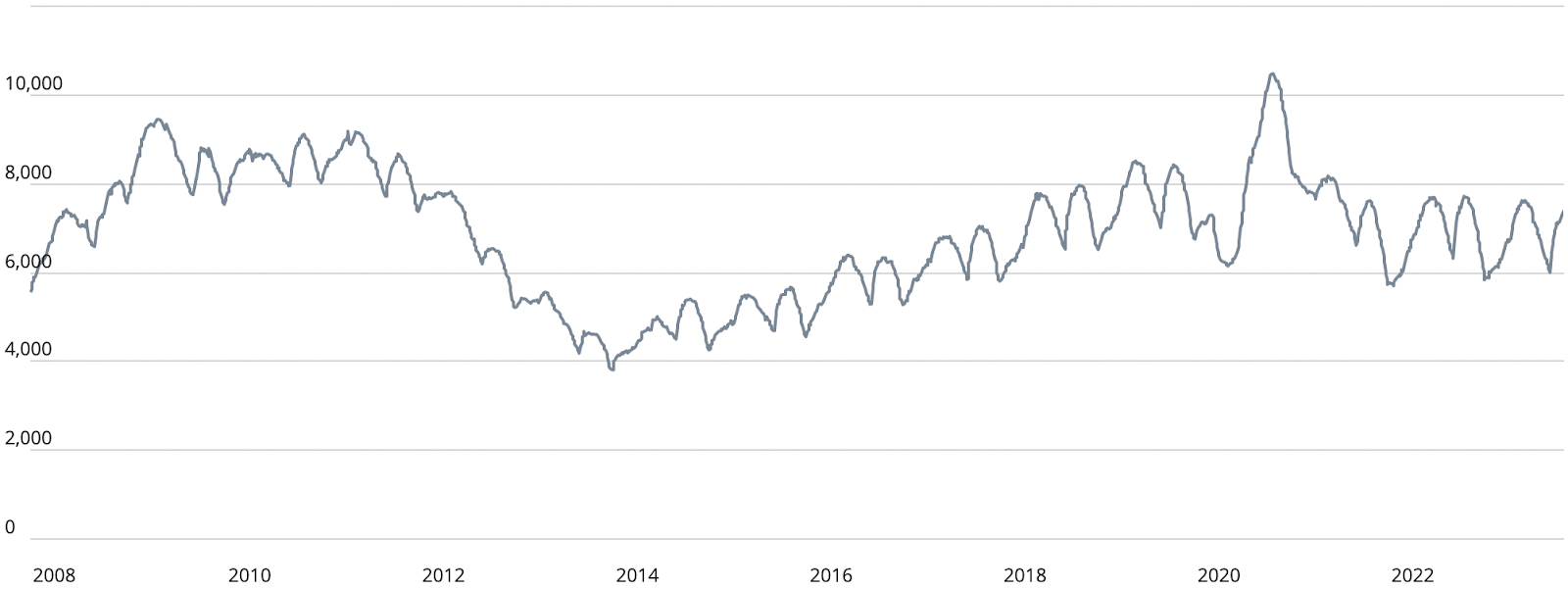

Manhattan Supply

Manhattan's real estate supply has rebounded from its September lows, swiftly climbing as we head into the fall season. This week, the inventory ratio stands at 7,404 available units to 210 units of demand, suggesting a market abundant in options for potential buyers. While in many national markets, such an imbalance might lead to price inflation due to scarce supply, Manhattan's market dynamics are different—with a surplus of listings, the city offers a diverse range of properties without the pressure of immediate scarcity, maintaining a competitive environment for both buyers and sellers.

Brooklyn Supply

Mirroring seasonal trends, Brooklyn's property supply has risen from its early September dip to 3,416 units, suggesting a peak later in the month. With a significant supply surplus, far more units are available than needed to satisfy this week’s demand of 134 units. This balance indicates a steadily active market where inventory levels support a healthy turnover rate.

Manhattan Pending Sales

This week, Manhattan's pending sales took an unexpected downturn, falling to 2,497 units. Despite this week's dip, the consistency of data before the pandemic suggests a potential rebound in the coming weeks. Historically, we've observed a pattern where sales pick up again, leading to what may be a secondary, albeit smaller, peak in activity around late November or early December. This anticipated upswing is reflective of the city's enduring appeal and the seasonal rhythms of the real estate market, signaling a temporary lull rather than a long-term decline.

Brooklyn Pending Sales

Brooklyn's pending sales mirrored Manhattan's unexpected dip this week, veering off the usual historical upward trend. With 1,830 pending sales recorded, the market experienced a slight contraction. However, this dip is anticipated to be a brief deviation from the norm. Forecasted trends and past data suggest a resurgence is on the horizon, with numbers projected to climb towards a modest peak as we approach the year's end.

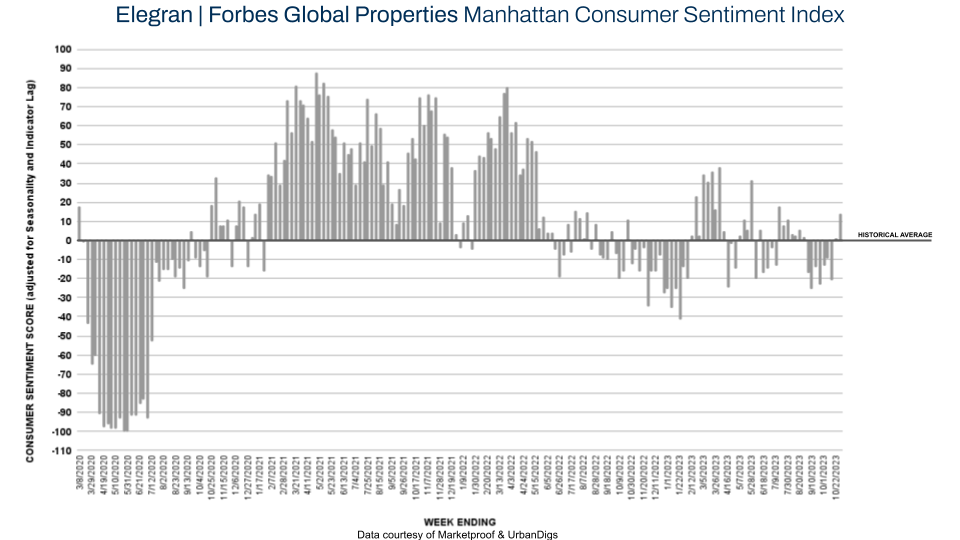

Manhattan Consumer Sentiment

This week in Manhattan, the Elegran | Forbes Global Properties Consumer Sentiment Index experienced a rise, moving from +1 to +14. This uptick reflects a growing positive attitude towards the Manhattan residential real estate market. Throughout the year, sentiment has shown a mixed pattern, but the current increase is a sign of strengthening confidence. The market saw 210 contracts signed this week, a notable rise from the previous week's 186, underscoring the enhanced optimism among buyers and investors in the face of a dynamic economic environment.

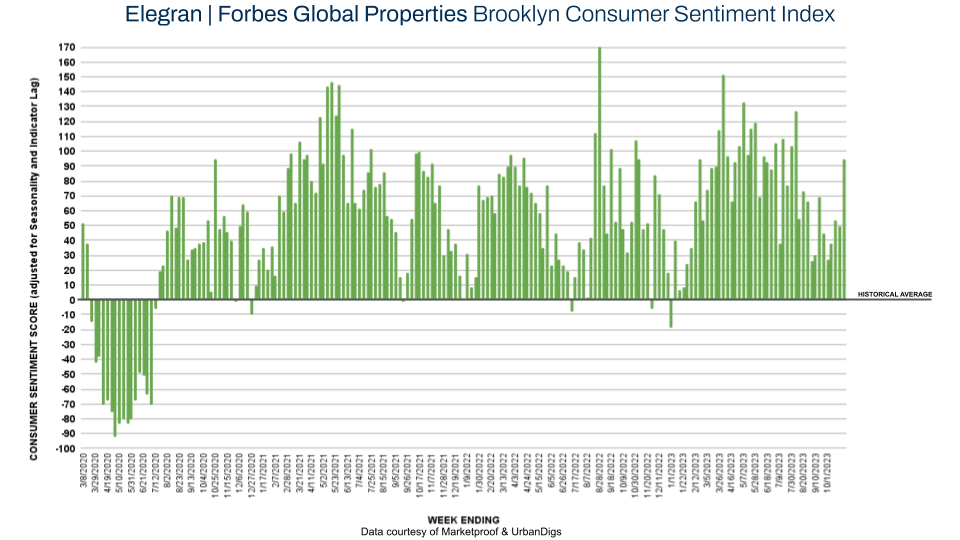

Brooklyn Consumer Sentiment

The Brooklyn Consumer Sentiment Index, curated by Elegran | Forbes Global Properties, leapt impressively this week from +50 to +94. This sharp increase signifies that sentiment towards Brooklyn's real estate is now 94% higher than its average before the pandemic, which has been consistently strong since July 2020. The robust consumer confidence is further evidenced by the number of contracts signed—rising from 117 last week to 134 this week—indicating a sustained and growing interest in Brooklyn's diverse and dynamic housing market.

New Development Insights

Marketproof reported that 31 new development contracts were signed in 24 buildings this week. The following buildings were the top-selling new developments of the week:

- THE CALYER GREENPOINT (Greenpont) reported four contracts.

- TRIBECA GREEN (Battery Park City),

- 12 BROOME ST (Greenpoint),

- 39 ARGYLE RD (Prospect Park South)

- SKYLINE TOWER (Long Island City)

Each reported two contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Recent Posts