Punishingly Efficient Markets

Written by Jared Antin of Elegran | Forbes Global Properties

While the data suggests that Manhattan tips in favor of sellers, many would-be sellers are finding a far more challenging reality. Recent metrics in the winter months show heightened contract activity alongside historically low inventory - conditions that typically favor sellers. Yet this market is actually punishingly efficient: properties that are pristine, perfectly positioned, and accurately priced sell quickly, while others stagnate.

This dynamic can be seen in the chart below, which shows the listing discount from the original ask for properties that sold quickly (under 60 days) versus those that lingered before finding a buyer (over 120 days):

The Data Tells One Story

December 2024 and January 2025 statistics confirm an unusual rise in contracts signed paired with more constrained supply than normal. In theory, low supply and robust demand should create an ideal seller’s market. Indeed, some segments of Manhattan real estate see multiple offers and vigorous bidding wars, particularly in coveted neighborhoods where properties are turnkey and positioned just right.

However, aggregate numbers can be deceptive. While certain listings do attract swift action, many others languish. The reason? Buyers in today’s Manhattan market are more patient and selective, looking for just the right combination of factors before committing.

Beyond the Numbers: The Buyer’s New Mindset

Gone are the days of fear of missing out (FOMO) or other external motivations related to significant price action. With abundant data at their fingertips, buyers carefully scrutinize every property. They know exactly what they’re looking for and what they’re willing to pay. Only listings that meet (or exceed) these high standards spark serious interest, reinforcing a market dynamic where even small missteps can lead to a stalled sale.

This raises the stakes for sellers. If a property isn’t drawing offers, it’s a strong signal that one or more aspects—be it price, presentation, size, or condition—need adjusting.

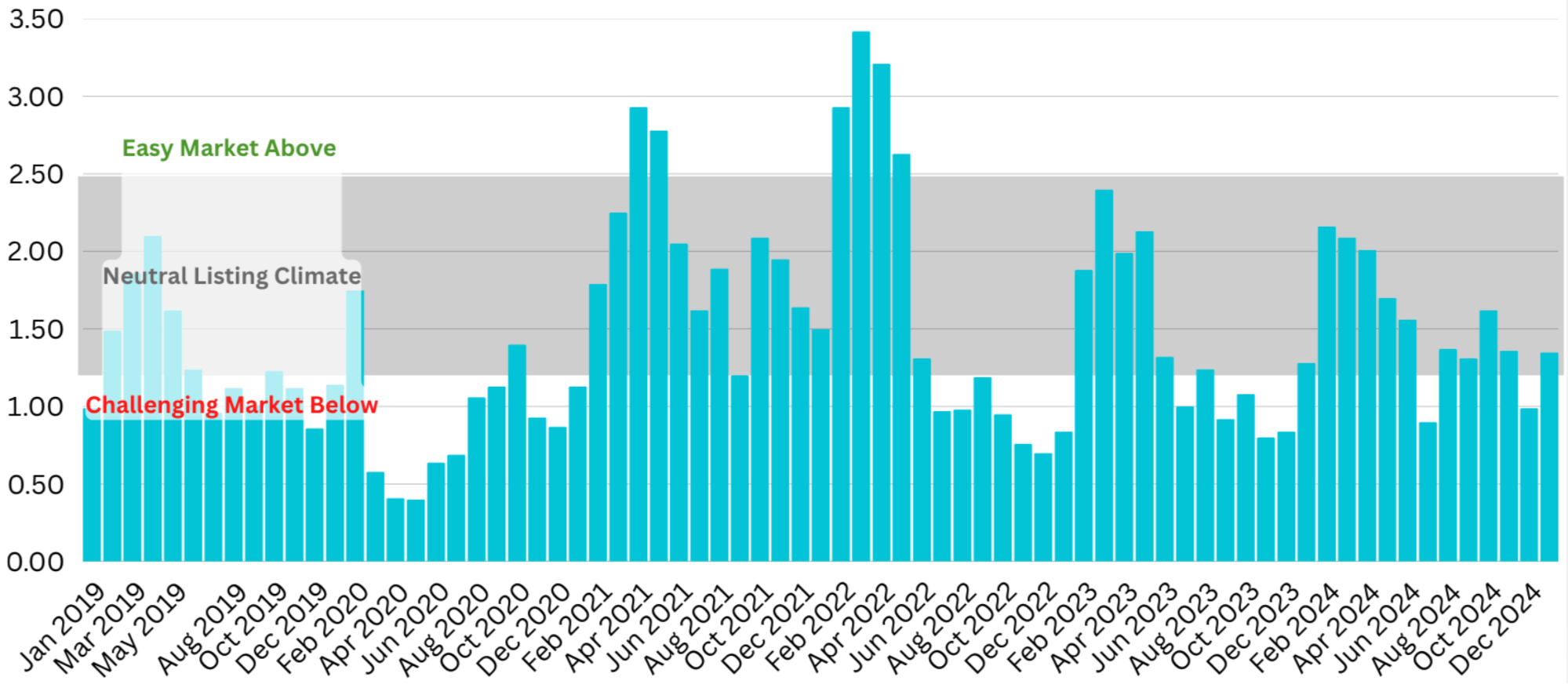

In such a challenging listing climate (see chart below), simply waiting for the “right” buyer is no longer viable.

Four Key Factors for Success

In this punishingly efficient market, four elements determine whether a property will sell or be overlooked. Missing the mark on any can be a deal killer—unless the price is adjusted accordingly to compensate.

(1) Price

Buyers are exceptionally price-conscious. Overpricing is a deal-breaker, particularly when buyers have many tools to gauge market value. A listing even slightly above the perceived “right” price can see little to no activity.

(2) Marketing Strategy

Presentation is paramount. From professional staging and photography to a compelling narrative, a property's marketing can differentiate it in a highly competitive landscape. Sellers who invest in top-tier marketing see a direct impact on buyer interest and final sale price.

(3) Property Composition

Size and layout matter. Studios are struggling to find demand, and overly large apartments don’t always command a straightforward premium on a per-square-foot basis. Buyers want the “right” size for their lifestyle, and they’re scrutinizing floor plans, layouts, and space with unprecedented care.

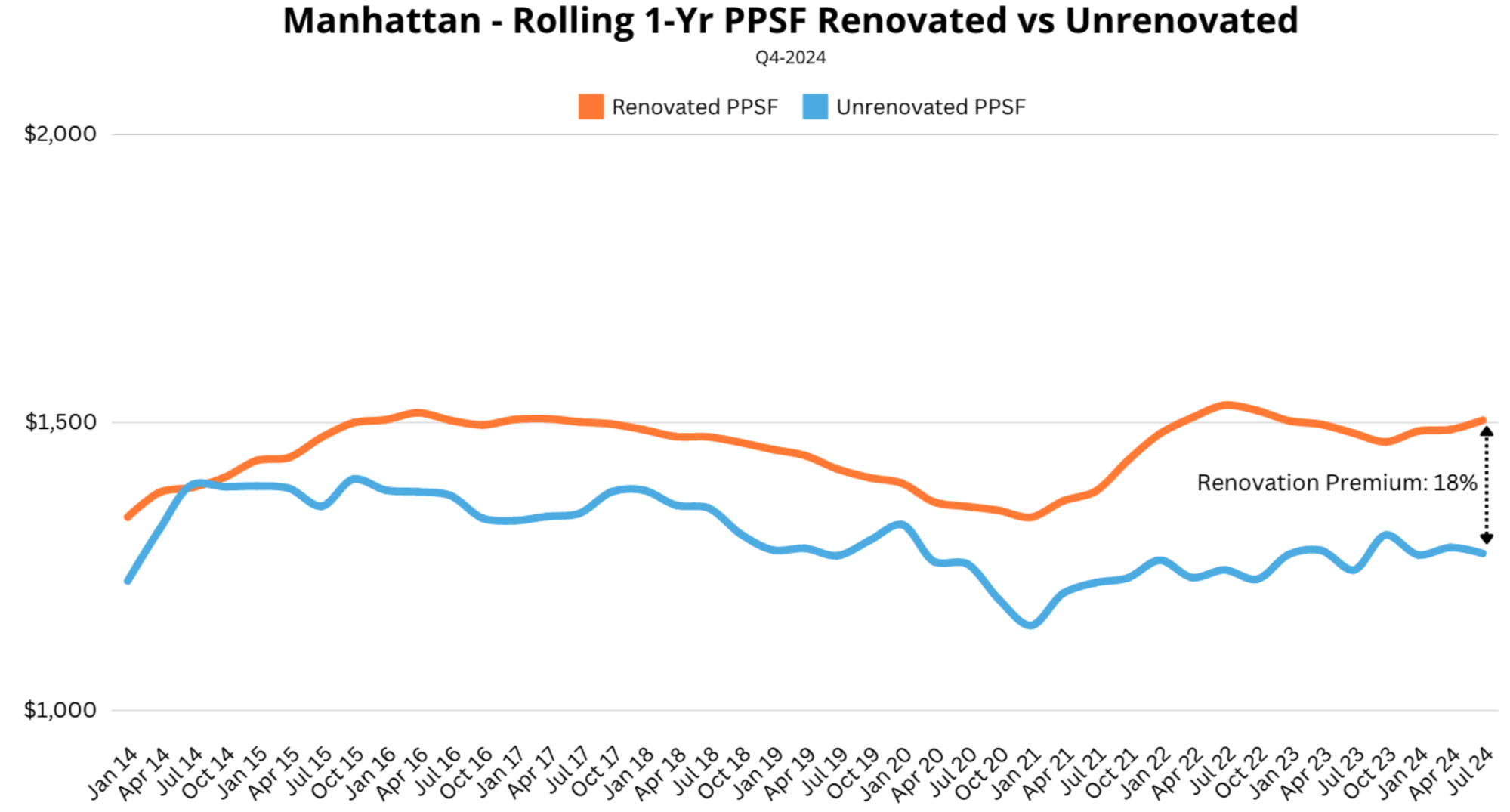

(4) Renovation Quality

Turn-key apartments that require little to no work fetch a premium and often sell quickly. Conversely, properties needing a full gut renovation can still move if discounted enough to entice buyers to take on the project. The real challenge lies with partially updated or 8–12-year-old renovations priced too close to mint-condition homes: Buyers often see these as requiring nearly as much work as an unrenovated property and expect a commensurate price concession. In short, the renovation premium is a very real force in today's markets.

All four factors must align to secure a timely and competitive sale. If any one aspect falls short, price is the only viable remedy to avoid a protracted listing.

The Unique Challenge of Co-op Transactions

Manhattan’s real estate landscape is further complicated by the co-op. Most co-ops require board approval, indirectly creating an unofficial “price floor” for transactions. If buyer interest only materializes at a number below what the co-op board will accept, the sale may not move forward at all. This extra layer of complexity means sellers must have a firm grasp on both market realities and co-op board expectations.

Strategies for Success in a Hyper-Efficient Market

(1) Price with Precision

Set a realistic asking price that reflects current market conditions and direct comparisons. Overpricing can stall a listing instantly.

(2) Emphasize Presentation

With savvy buyers focusing on every detail, staging, professional photography, and a cohesive property narrative can make all the difference in generating offers.

(3) Know Your Micro-Market

Every Manhattan neighborhood (and building) has its own nuances. Whether it’s downtown loft living or Upper East Side co-ops, understanding the specific buyer pool is key.

(4) Stay Flexible

The market provides near-instant feedback. If activity is slow, reconsider the price, enhance the presentation, or adjust your strategy before the listing grows stale.

(5) Anticipate Co-op Nuances

Factor in board requirements, which could impose practical limits on how low you can price. If you can’t price below a certain point, ensure the other three factors (marketing, composition, and condition) are especially strong.

The Takeaway

Yes, the data points to a market that nominally favors sellers. However, in reality, only listings that meet every essential criterion see multiple offers and quick sales. Others face a demanding landscape in which highly informed, selective buyers wait for a property that’s just right or adjust its price to the precise sweet spot.

In a city where every square foot and every dollar matters, Manhattan’s market is punishingly efficient: it immediately rewards those who align price, marketing, composition, and condition—and just as swiftly sidelines those who don’t.

And for some listings, the hard truth is that there simply may not be a market at a price acceptable to the seller—or the co-op board. Whether you’re a buyer seeking that perfect property or a seller aiming to maximize value, understanding these nuances isn’t merely helpful—it’s essential.

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran | Forbes Global Properties, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Recent Posts