Elegran Brooklyn Market Update: February 2025

Overall Brooklyn Market Update: February 2025

A Balanced Market with Signs of Strength

Brooklyn’s real estate market entered 2025 with a steady balance between buyers and sellers, showing resilience despite seasonal slowdowns. January data reflects typical post-holiday adjustments, with modest inventory growth, steady contract activity, and early signs of price stabilization—all setting the stage for a dynamic spring season.

Inventory rose 3.1% month-over-month to 2,899 units, a 2.7% annual increase, giving buyers slightly more options. However, supply remains historically tight, keeping seller pricing power intact. Contract activity followed seasonal trends, declining 13.9% from December but remained 2.3% above January 2024 levels, signaling stable buyer demand.

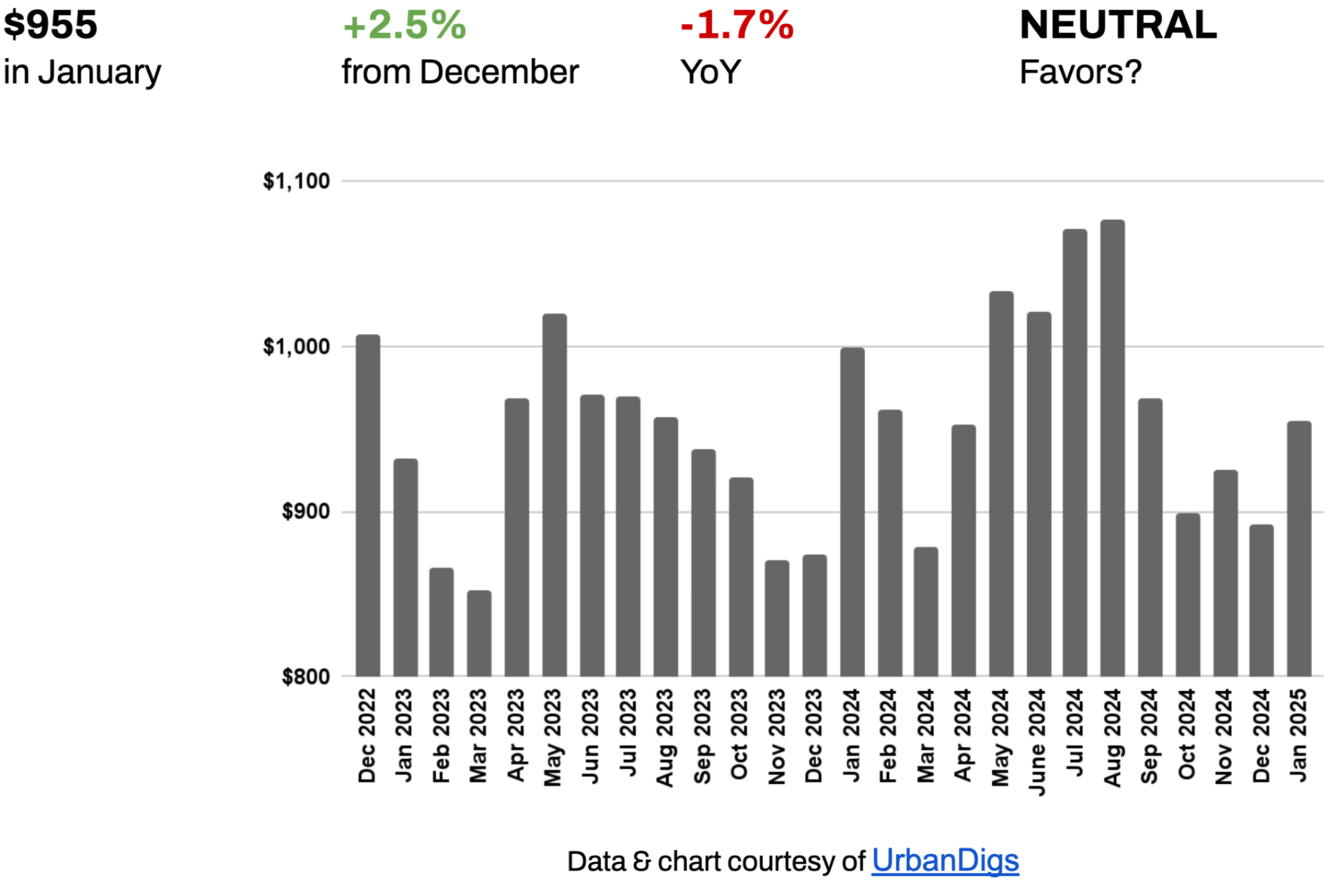

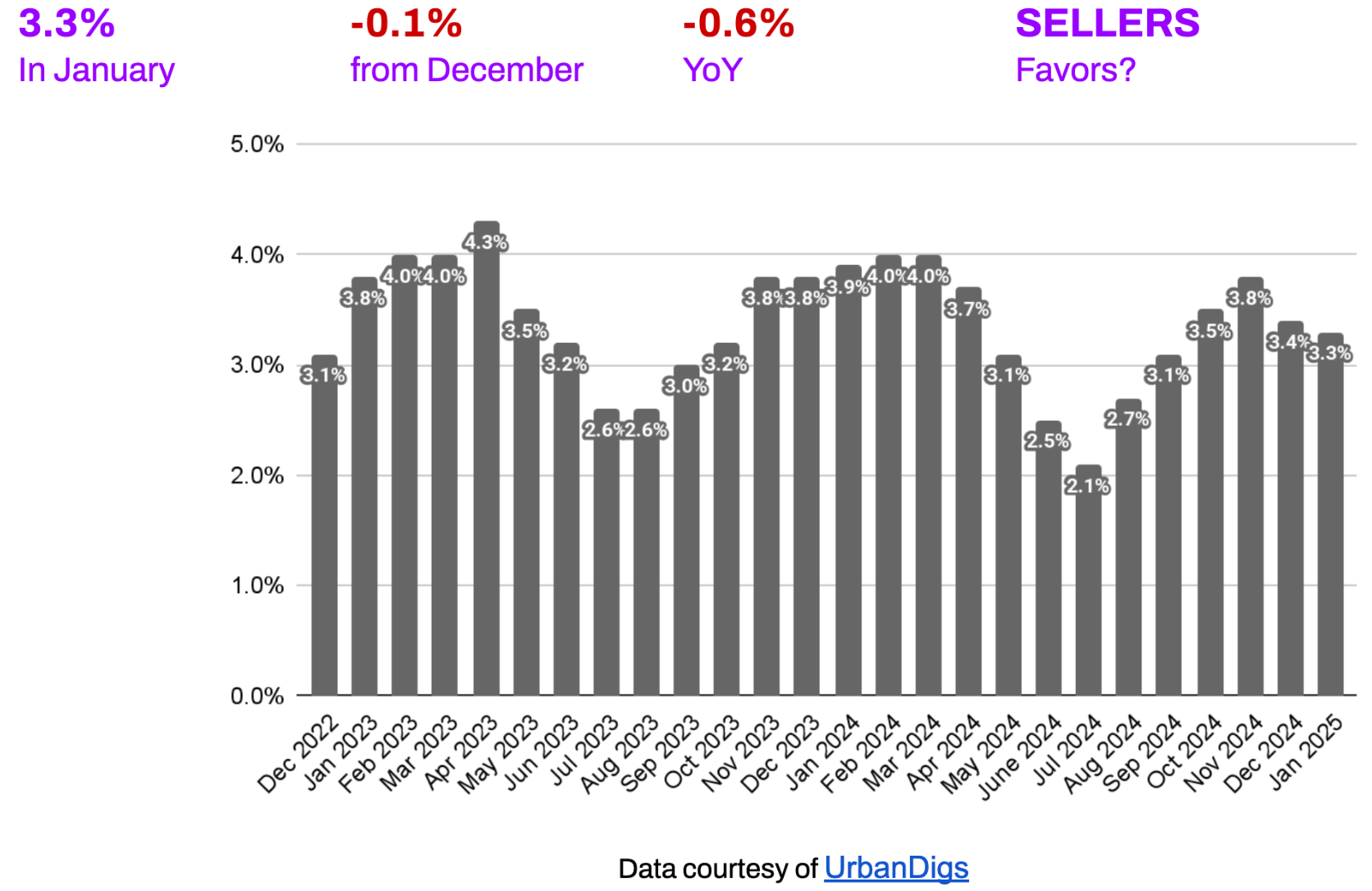

Pricing trends were encouraging, with the median price per square foot (PPSF) rising 2.5% from December to $955, suggesting potential price stabilization despite being 1.7% below last year’s levels. Sellers maintained strong positioning, with the median listing discount tightening to 3.3%, reinforcing a competitive market where well-priced homes attract firm offers.

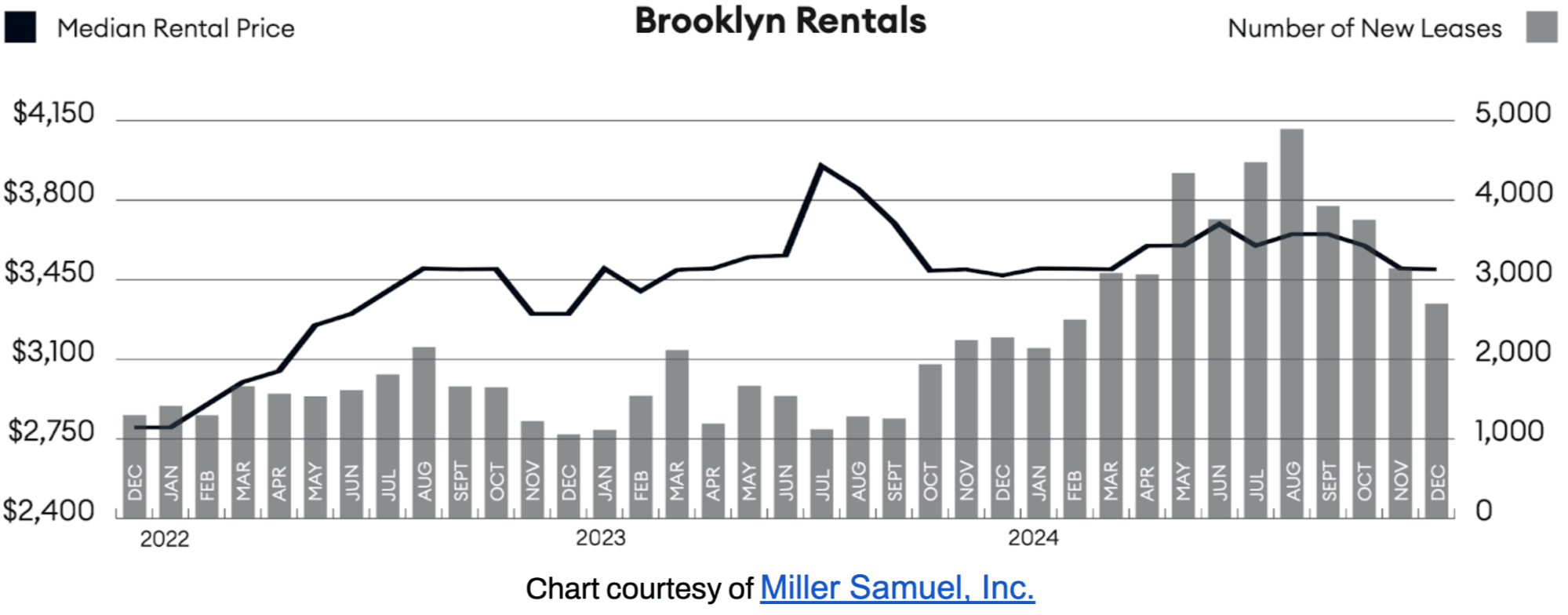

Brooklyn’s rental market held firm, with median rents at $3,495, maintaining near-record levels. Persistently high rents could push more renters to consider buying, adding fresh demand pressure to the sales market in the coming months.

Looking ahead, several macroeconomic factors will shape Brooklyn’s market trajectory. Inflation trends, Federal Reserve interest rate decisions, and the ripple effects of tariffs and global trade tensions will influence buyer confidence, affordability, and transaction volume. Brooklyn is poised for continued resilience with tight inventory, stable pricing, and a strong rental market. Buyers should act strategically in a competitive environment, while sellers who price appropriately will continue to see demand.

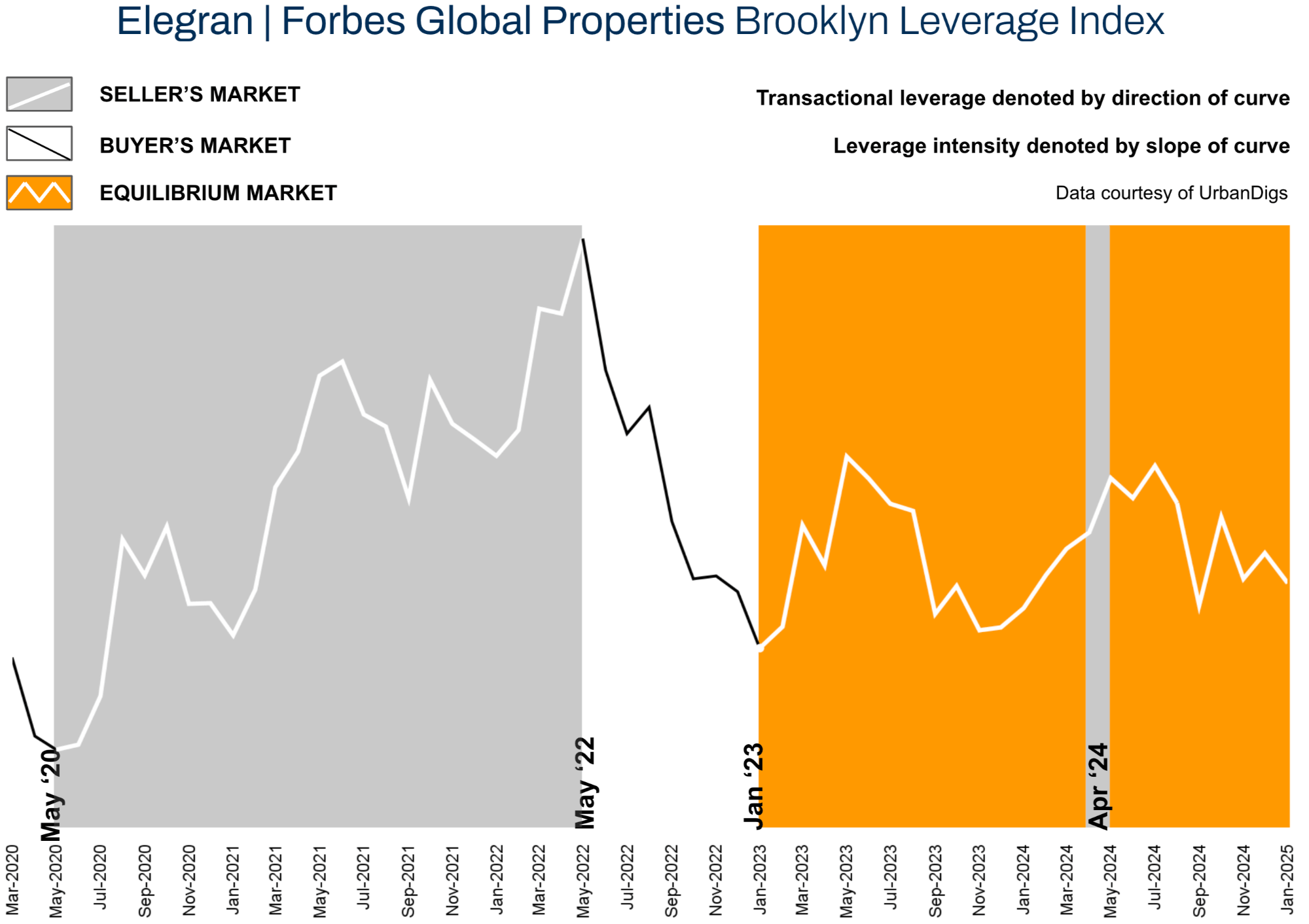

Elegran | Forbes Global Properties Brooklyn Leverage Index

The Elegran | Forbes Global Properties Brooklyn Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

It's not just the exact numbers that matter—it’s the direction and slope of the trend. After a brief seller’s market in spring 2024, Brooklyn shifted toward buyers over the summer, only for sellers to regain momentum in the fall as contract activity surged. November saw a slight tilt back to buyers, but the year ended with a seller’s edge. In January 2025, the market has softened in buyers’ favor again—reflective of a seasonal slowdown typical of the post-holiday period and unlikely to last.

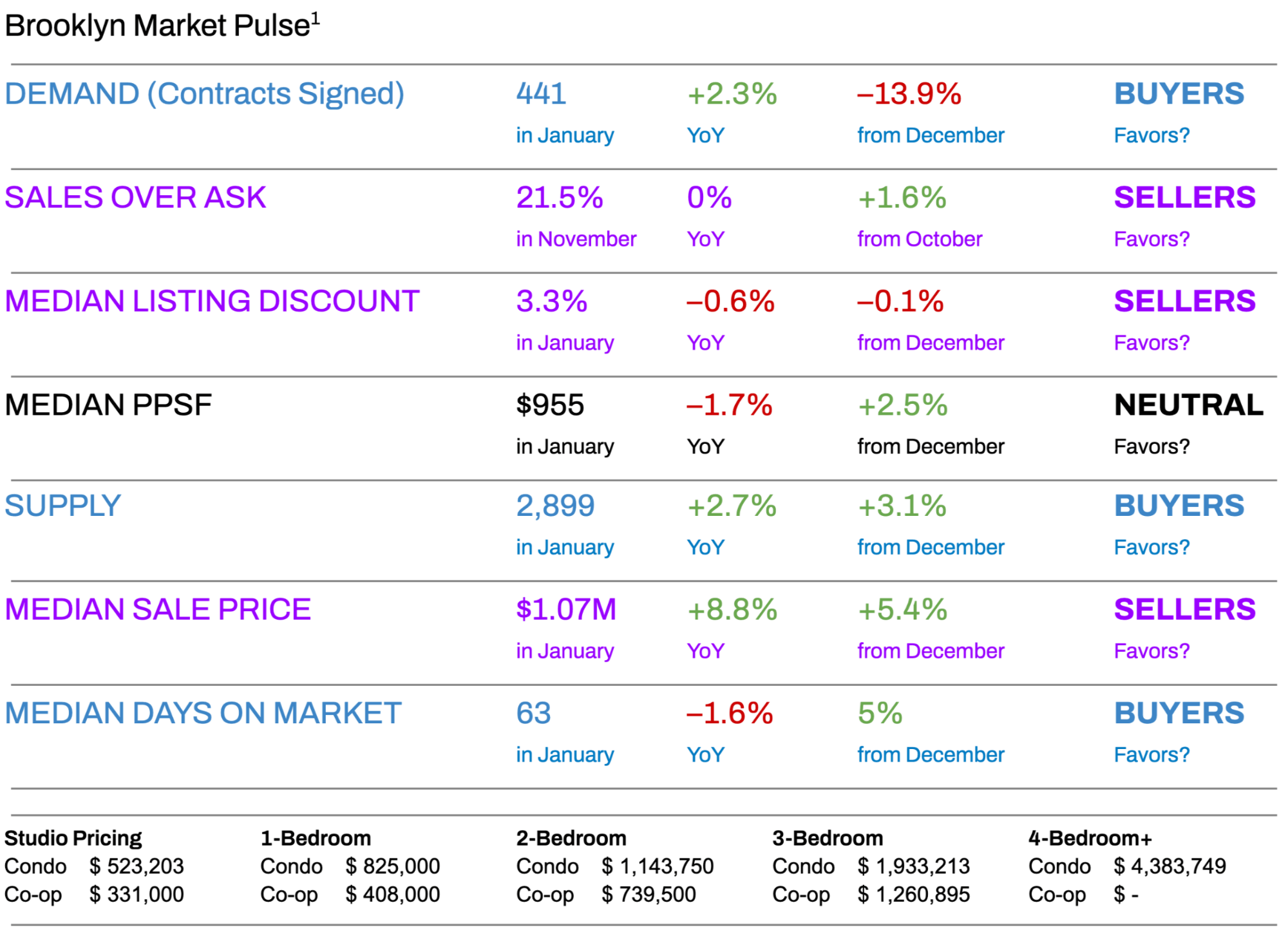

Brooklyn Supply

Brooklyn’s housing supply rebounded seasonally in January, rising 3.1% to 2,899 units as the market emerged from December’s holiday lull. This increase aligns with typical post-holiday patterns and marks a modest 2.7% year-over-year gain. While this suggests a slight easing of inventory constraints, supply remains well below the higher levels seen in 2021 and 2022, reinforcing Brooklyn’s long-term trend of tightening inventory.

The seasonal return of sellers bringing new listings to market and slower contract activity than in December allowed inventory to build slightly. However, this increase should be viewed in the context of Brooklyn’s persistently low inventory over the past two years.

What does this mean for:

- BUYERS: A modest rise in inventory offers slightly more choices and could slightly reduce competition for certain apartments compared to December’s tight conditions.

- SELLERS: Despite the increase, supply remains historically low, preserving pricing power for well-positioned properties.

As we move deeper into Q1 2025, this delicate supply-demand balance will continue shaping Brooklyn’s market. While buyers may find slightly more options, competition remains strong—especially for well-priced homes in desirable neighborhoods.

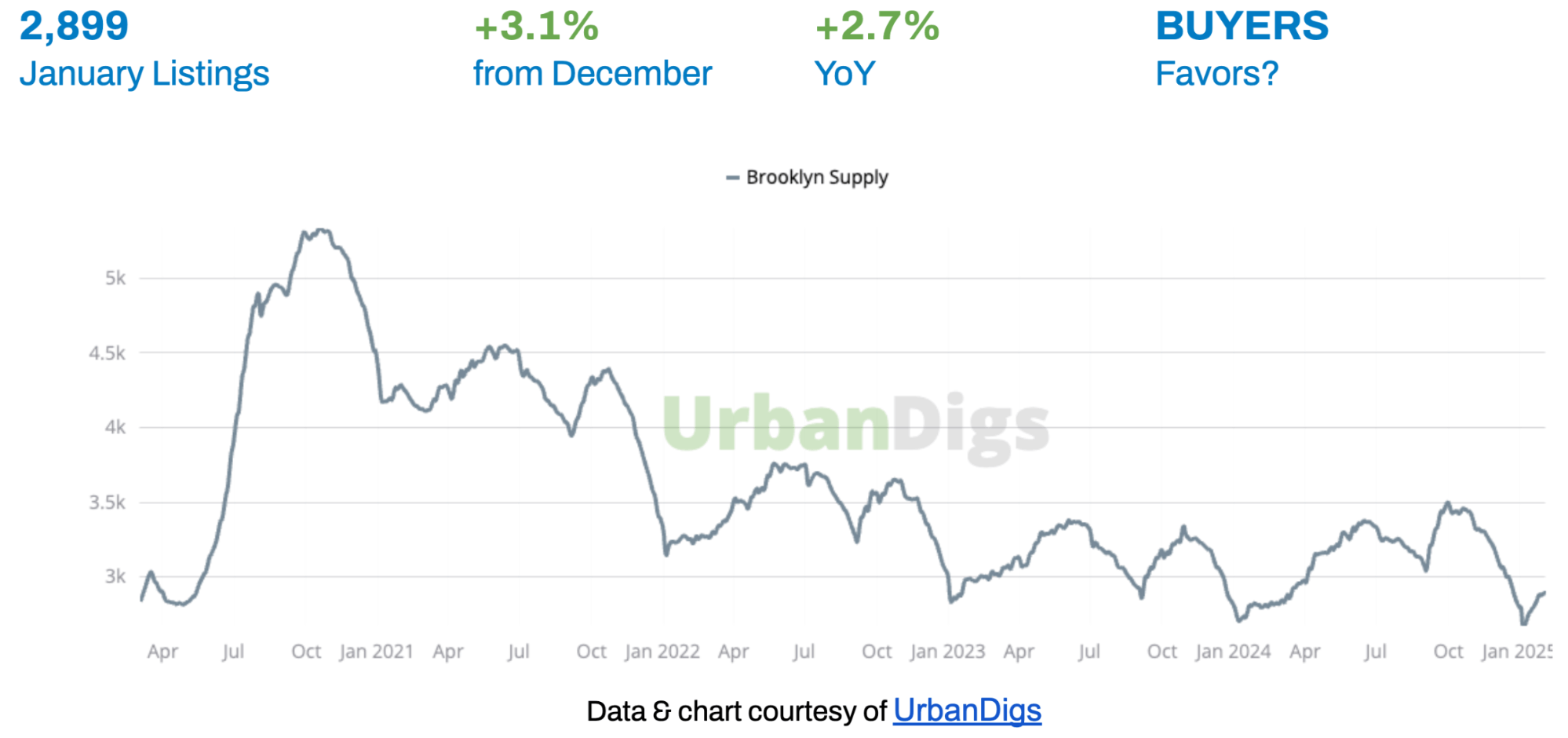

Brooklyn Demand

Brooklyn’s residential market experienced a typical seasonal slowdown in January, with contract activity dropping 13.9% from December to 441 signed contracts. While this decline may seem significant, it reflects the usual post-holiday lull rather than any fundamental market weakness. A broader perspective reveals stability—contract activity rose 2.3% year over year, signaling steady demand despite short-term fluctuations.

While contract volume remains 11% below January 2023 levels, the current pace aligns with historical seasonal trends. After the strong rebound in 2024, the market is finding its equilibrium.

What does this mean for:

- BUYERS: Year-over-year growth highlights continued market strength, meaning competition for well-priced properties remains.

- SELLERS: Despite the monthly drop, the annual gain signals sustained demand, reinforcing market stability.

As the market heads into spring, expect contract activity to pick up, following the typical seasonal pattern of increased transactions in the warmer months.

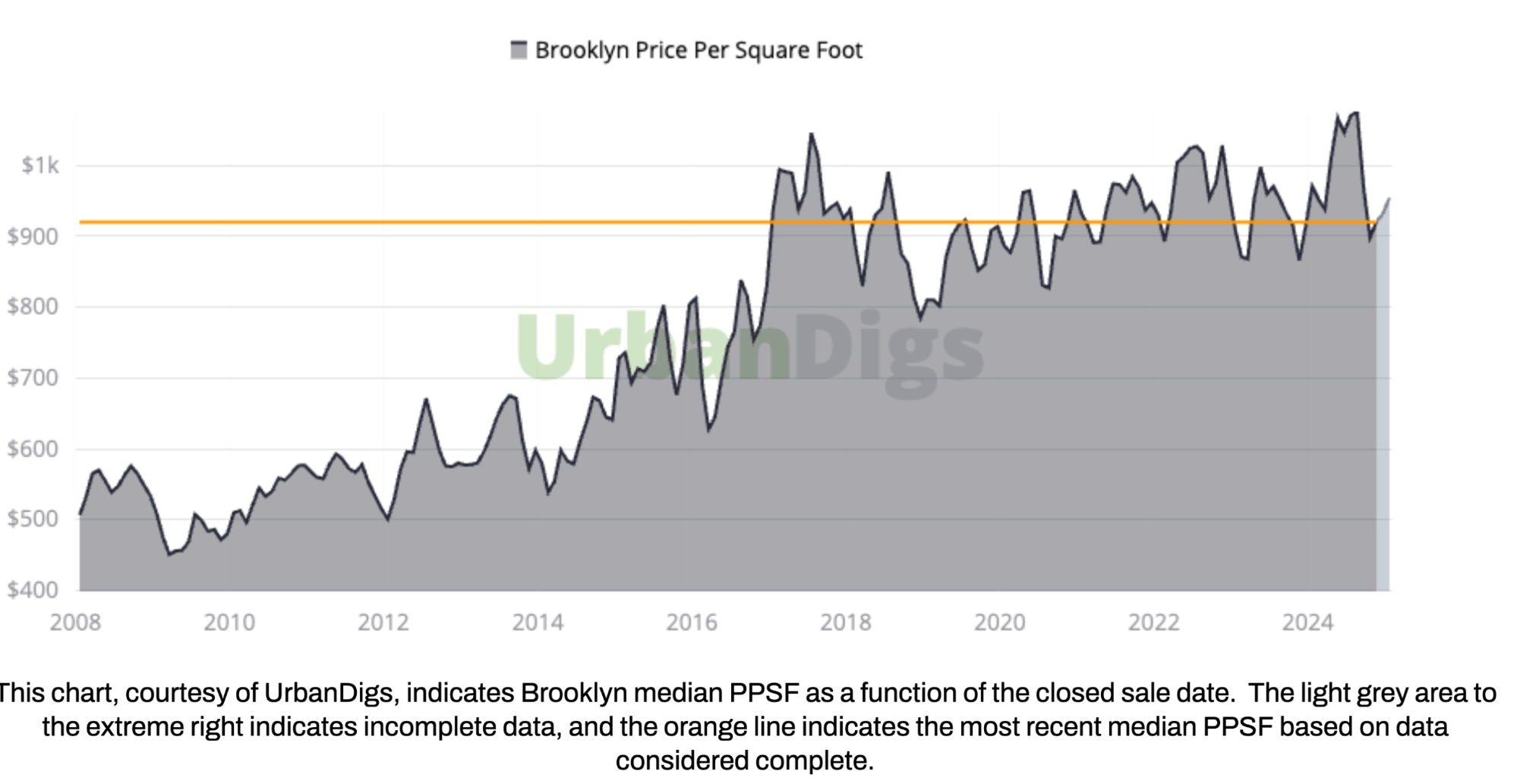

Brooklyn Median PPSF

Brooklyn’s median price per square foot (PPSF) showed early signs of stabilization in January, rising 2.5% from December to $955. While still 1.7% below January 2024 levels, this month-over-month rebound suggests the market may be finding its footing after a seasonal dip. The increase is particularly notable following December’s sharper decline, hinting at a potential turning point in pricing trends.

January’s pricing likely reflects contracts signed in late fall, when market activity began to regain momentum. The modest year-over-year decline should be seen in the broader context of 2024, a year shaped by higher interest rates and economic uncertainty, which influenced buyer behavior and pricing strategies.

What does this mean for:

- BUYERS: While prices have ticked up from December, the year-over-year decline still presents strategic buying opportunities. If this monthly increase marks the start of a broader recovery, today’s pricing may offer an attractive entry point before further appreciation.

- SELLERS: The month-over-month rebound signals improving conditions. Sellers who price their homes in line with current market realities—rather than peak 2024 levels—are more likely to attract serious buyers.

Several factors could shape price trends in 2025, including potential interest rate adjustments, tariff impacts, spring inventory levels, and broader economic conditions.

Brooklyn Median Listing Discount

Brooklyn’s residential market maintained its pricing strength in January, with the median listing discount tightening to 3.3% from 3.4% in December. This marks a 0.6% year-over-year reduction, signaling sustained seller pricing power despite seasonal market fluctuations. The narrowing gap between asking and selling prices reflects realistic pricing strategies and steady buyer demand, even during the typically slower winter months.

These figures reflect deals negotiated in the fall when the market remained resilient despite higher interest rates and economic uncertainties. Even as overall market activity moderated, the continued compression of listing discounts suggests that well-priced properties are attracting strong buyer interest with limited room for negotiation.

What does this mean for:

- BUYERS: The shrinking listing discount highlights a competitive market where significant negotiation is less effective. Buyers should be prepared with strong offers on well-priced properties, as sellers are less likely to entertain steep price reductions.

- SELLERS: The sustained tightening of discounts reinforces seller confidence. Those who price strategically in line with current market conditions are more likely to secure strong offers with minimal concessions.

As the market moves toward the busier spring season, expect pricing strength to persist, favoring sellers who remain realistic and responsive to buyer demand.

Rental Remarks

In December, the median rental price in Brooklyn decreased very slightly to $3,495, down from $3,500 in October. This reflects a nearly unchanged environment with only a 0.1% month-over-month decline. Despite this slight monthly drop, the median rent recorded a modest year-over-year increase of 0.7%, marking the third consecutive month of annual growth. New lease signings have also grown significantly, rising consistently for the fifteenth consecutive time.³

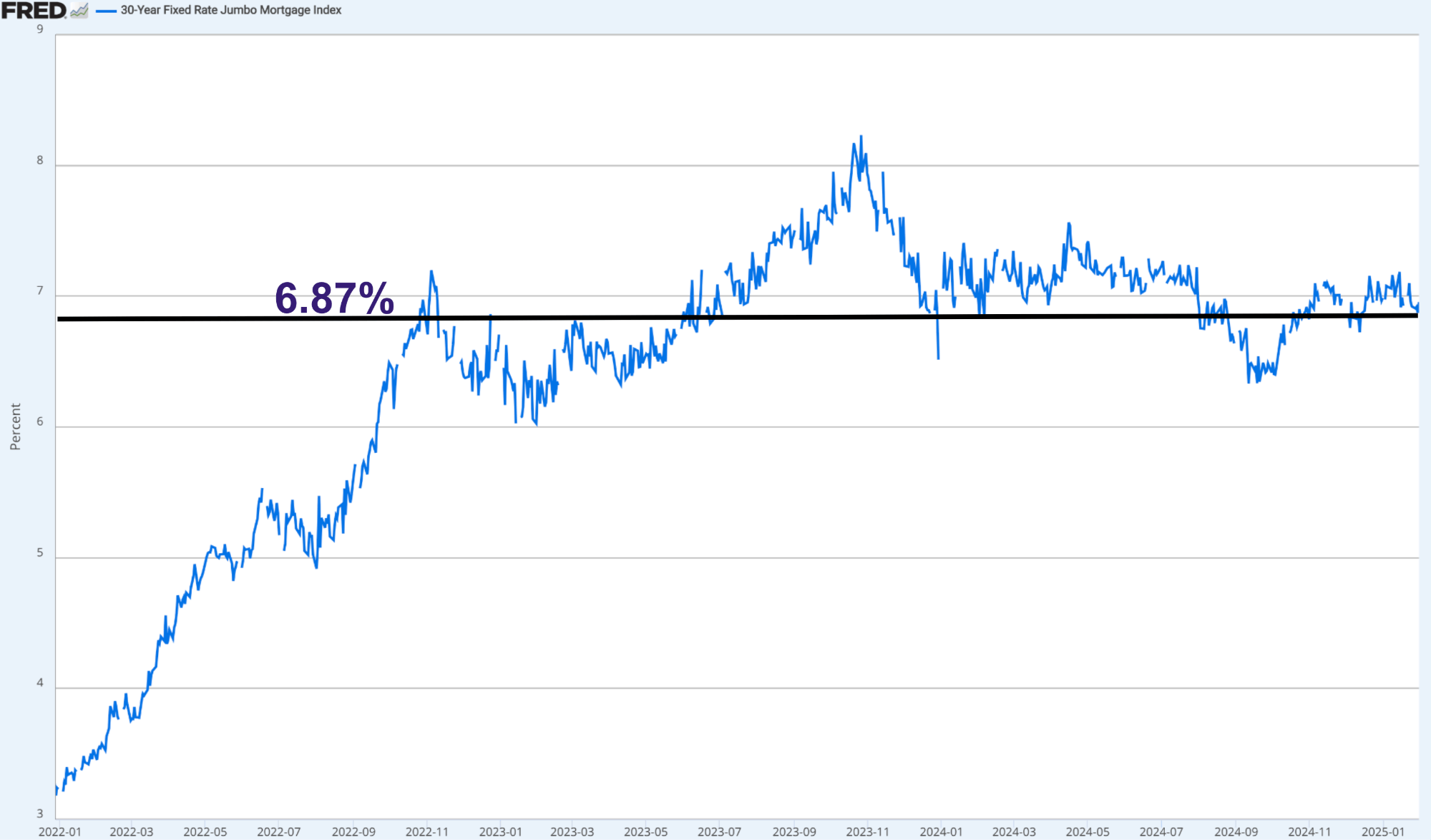

Mortgage Remarks

The 30-Year Fixed Rate JUMBO Mortgage Index is currently at 6.87%⁴, while the average JUMBO Annual Percentage Rate (APR) stands at 6.7%⁵. Although these rates declined in late August and into mid-September, they have since risen by 80 basis points from their mid-September low. Additionally, in late January, the Federal Reserve chose to keep interest rates unchanged rather than lowering them.

As economic uncertainty declines, interest rates are expected to stabilize. This stabilization should provide much-needed confidence for both buyers and sellers, encouraging transactions and alleviating market gridlock. A more predictable interest rate environment can strengthen trust in the real estate market, fostering increased activity and smoother transactions.

Investor Insights

Total returns in Brooklyn are driven by a combination of net rental income and capital appreciation. Current cap rates range from approximately 3.0% to 3.4% for all-cash investors. However, with the average JUMBO mortgage APR at 6.7%, net income potential remains elusive for those heavily relying on leverage. For foreign investors, the timing couldn’t be better. A strong U.S. dollar relative to native currencies enhances the opportunity to realize meaningful capital gains when selling assets in Brooklyn.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo.

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

About Us

Welcome to Elegran | Forbes Global Properties, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Recent Posts